Just Giving

I'm interviewing Rob Reich on my podcast soon. As preparation for that interview, I wanted to review his most recent book, Just Giving, which I loved (I highlighted 15% of the book, compared to my average of 5 percent!). Just Giving is an analysis of philanthropy through a "political theory" lens. It looks at how philanthropy (as an institution) co-evolves with democratic nation-states (as institutions). It's a less-story-driven, more academic version of Anand Giridharadas' Winners Take All. Or, alternatively, it's the institutional version of Effective Altruism. In this review we'll look at:

- What is a political theory of philanthropy?

- Two historical examples of how philanthropy co-evolved with the state: in ~4th century Athens and in ~16th century Islamic states

- The history of philanthropic foundations in the U.S.

- How foundations help/hinder the goals of the state, and how they can be used to combat "presentism" for intergenerational justice.

Let's begin!

What is a Political Theory of Philanthropy?

First, Reich contrasts his political perspective on philanthropy against the usual philosophical, moral, individual perspective:

Taking this [philosophical] approach is to ask questions about private, individual morality. It is to ask about how you or I should practice philanthropy. This book takes a different approach. I make questions about philanthropy a compelling topic of inquiry for public morality, or for political in addition to moral philosophy.

Reich restates this same idea in a couple of different ways, each of which is differently (deliciously) textured:

One might say that I aim to examine the norms, drawn from the independent standing of liberal democratic justice, that ought to inform the institutional setting in which philanthropy takes place.

A political theory of philanthropy views philanthropic activity as sitting in a variety of relationships to the state.

A political theory of philanthropy will focus our attention not on individual philanthropic activity and its political dimensions but on the institutional arrangements or regulatory structure of philanthropy, such as legal rules.

Effective altruists have a powerful private morality for informing giving—fund proven and highly effective charitable organizations that maximize human or animal welfare—but they have ignored the implications for public morality.

A History of Philanthropic Institutions w.r.t. The State

First, Reich gives a historical perspective of how philanthropy has co-evolved with the state:

Philanthropy may be a universal and time-immemorial activity, but because its practice is embedded within different social norms and structured by different institutional arrangements, it takes on different forms in different places at different times.

More specifically, Reich examines:

- The liturgical system and antidosis procedure in classical democratic Athens

- The creation in Islamic societies of the waqf, a precursor to the modern foundation

1. The liturgical system and antidosis procedure in 4th-century Athens

The state of Athens developed a system "in which private donations for the production of public benefits were routine" (called a "liturgical system"). This system was crucial for state revenue:

According to some estimates, the sum total of liturgies accounted for more than half of all state revenue in fourth-century Athens.

Reich highlights how this liturgical system was strongly based on Grecian norms:

The liturgical system in Athens cannot be understood apart from deeply seated social norms in ancient Greece that prized competition, honor, and virtue. Wealthy citizens sometimes competed for the privilege of liturgical service, expecting in return for their donations both honor and gratitude for their status as a civic benefactor.

Though these norms eventually became embedded in law:

During this period, what was once the voluntary prerogative of the wealthy under oligarchy to undertake liturgies became regulated by law.

Here is how the system worked:

- The state "calls on" a rich person to give:

The Athenian state kept registers of wealthy people, and if one had not performed a liturgy recently, which typically qualified a person for temporary exemption, the state could select that person to donate for the provision of a warship and perform the needed service.

2. The wealthy person could "counter" by invoking "antidosis", an equalizing process to get other wealthy folks involved:

Instead of accepting the appointment, one option was the antidosis, in which the appointed person could attempt to resist liturgical service by pointing out the fact that other citizens with even greater resources were not volunteering and had not performed any significant liturgy recently.

And here is where things become especially interesting. If the challenger refused, the initially appointed person could offer to exchange estates with the wealthier person and, with that person’s estate now in his possession, carry out the liturgy.

The appointed person, who was likely to have better knowledge than public officials of a neighbor’s true wealth, could exchange estates with the neighbor and then perform the liturgy. The system gave officials visibility into the comparative wealth of the Athenian elite.

Fascinating system, right? One where the state calls on a wealthy person to give, but that wealthy person can "deflect" that giving to a wealthier person (who was incentivized to do it, or else they'd have their assets swapped with the poorer person). Here are my takeaways:

- Norms eventually get legibilized and embedded in the state as laws. I might call this process (of norms --> laws) "institutionalization". A similar process exists across generations for [norms parent] --> [norms child]. I might call this "socialization". This can happen across any of the 4 parts of Lessig's dot. DMCA is an example of laws --> code.

- In Athens, the wealthy "competed" on status, just like we do today. Back then the axes of status were things like "competition, honor, and virtue". The liturgical process can be understood as a state-sponsored Status-as-a-Service.

- The antidosis process reminds me of other public good mechanisms that find an equilibrium (Quadratic Funding, Vickrey auctions, etc.). It is especially similar to Harbenger taxes, because there is an "organic swapping" mechanism to find the maximum. (In antidosis, the wealthy "swap" until they find the richest person. In Harbenger, the bidders increase the price until they find the highest bidder.)

2. The creation in Islamic societies of the waqf, a precursor to the modern foundation

The waqf is a form of charitable endowment, when one donates "a building, plot of land or other assets for Muslim religious or charitable purposes with no intention of reclaiming the assets." Similar to the liturgical system above, lots of money flowed through the waqf system:

By the 1800s, records document the existence of twenty thousand waqfs in the Ottoman Empire generating annual revenue equivalent to one-third of annual state revenue. [When the] Republic of Turkey was founded in 1923, upward of 75 percent of all arable land had been set aside in waqfs. Smaller but nevertheless still significant percentages — on the order of one-third of all land — could be found in nineteenth-century Tunisia, Algeria, and Egypt.

Waqf's are similar to modern foundations in a variety of ways:

Like a waqf, the private foundation consists in the legally sanctioned establishment of an endowment whose assets and income-generating revenues are directed to fund a wide variety of public benefits. Like a waqf, the assets of a private foundation are generally exempt from taxation, and therefore the decision to establish a foundation can be understood as a mechanism for sheltering wealth from taxation. Like a waqf, the private foundation enshrines fidelity to donor intent and does so beyond the death of the donor.

These waqfs may explain why democracy came later to Islam:

There is significant scholarly controversy about whether the widespread creation of waqfs, the considerable amount of untaxed land that accumulated in waqfs over time, and their institutional features that inscribed donor intent and perpetual existence help to explain why democracy did not take root earlier in Islam.

And, like the antidosis procedure, these waqfs were eventually legibilized and institutionalized by the state:

In the 19th century, the Ottoman Empire centralized the administration of waqf assets, and in the twentieth century, the modern waqf emerged via legal reforms in Turkey, Egypt, and other predominantly Muslim states, which permit a waqf to be founded by a group, to undertake fund-raising, and to invest assets in the commercial marketplace. In this form, the waqf is a more conventional NGO.

My main takeaway for the waqfs is this: That, in addition to legibilizing and institutionalizing existing forms of public good production, the state also competes with these institutions for public good production (i.e. the state "competing" with waqfs for taxable land).

A History of Philanthropic Institutions in the U.S.

Moving away from a global historical perspective, Reich then highlights the rise of philanthropic foundations in the U.S. He criticizes them thusly:

The modern philanthropic foundation is perhaps the most unaccountable, nontransparent, peculiar institutional form we have in a democratic society.

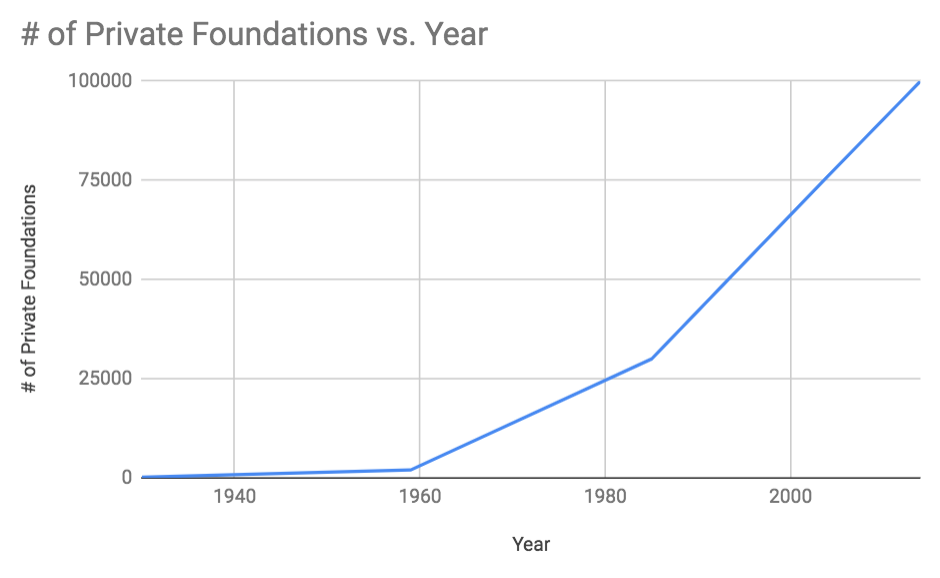

Although foundations only account for 15% of charitable donations, we've seen the number of foundations rise dramatically in recent years:

In 1930, 200 foundations held $1B in assets. Today, 100k foundations hold nearly $800B. In rough "order of magnitude" terms, I think of this as a 1000x increase over the last 100 years:

- 1930, 100 foundations, $1B in assets

- 2030, 100k foundations, $1T in assets

But, like many things that seem static today, this was not always the case. In fact, the 1st philanthropic foundation (The Rockefeller Foundation) was founded in 1913. The norms/laws we have calcified today are the result of its idiosyncratic founding. Initially, Rockefeller had a difficult time pushing his foundation through the Federal Government, so he made a variety of concessions to get it passed:

Rockefeller proposed to cap the size of the foundation at $100 million, to require that all investment returns on the initial principal be spent annually, and that the foundation spend out its endowment entirely within fifty years. Most significant of all, Rockefeller proposed that the governance of the foundation be partially public, making the work of the foundation formally accountable to the broader community. This would be accomplished by making members of the board of trustees subject to a veto by a majority of a congressionally appointed board consisting of various political leaders (the president of the United States, the president of the Senate, the Speaker of the House, and the chief justice of the U.S. Supreme Court) and educational leaders (the presidents of Harvard, Yale, Columbia, Johns Hopkins, and the University of Chicago).

To us in 2019, it feels quite strange to have a private foundation that is transparent, accountable, and (more) democratically governed. Unfortunately, Congress didn't allow his foundation and so Rockefeller went through New York State instead, removing all of his concessions in the process. Womp womp. My biggest takeaway is this: there is a foundational moment where laws regulate new things, but after that those laws calcify the status quo for many years.

How Does Philanthropy Help or Hinder the Goals of the State?

After looking at this historical account, Reich examines how philanthropy (and philanthropic foundations) co-evolve with the state. i.e. How do they help/hinder the goals of a liberal democracy? Reich calls this a "political theory of philanthropy". At a macro level, Reich looks at how philanthropy helps/hinders two specific value liberty and equality. His macro conclusion is that the liberty of philanthropic giving often diminishes equality.

In some sense, I hope to make a familiar point about liberty and equality and apply it to philanthropy. The familiar understanding about liberty and equality sets these two ideals in tension with one another.

“Total liberty for the wolves is death to the lambs.” - Isaiah Berlin

More specifically, Reich looks at justifications for the tax deduction/subsidy (which in the U.S. was worth $50B, or 1% of all federal revenue). He outlines three traditional arguments for the subsidy: a tax base rationale, an efficiency rationale, and a pluralism rationale. In more detail:

The first justification is that the deduction is necessary in order to account for the proper base of taxable income; the deduction, in other words, is no subsidy at all. The second justification is that the deduction efficiently stimulates the production of public goods and services that would otherwise be undersupplied by the state. The third justification links the incentive to the desirable effort to decentralize authority in the production of public benefits and, in the process, to support a pluralistic civil society that is itself an important component of a flourishing democracy.

At a high level, Reich's conclusion is this:

While I find nothing to recommend the tax base rationale, the efficiency and pluralism rationales do offer potentially good reasons to support subsidies for philanthropy.

1. Tax Base Rationale

First, note that, "unlike subsidy justifications, the tax base justification focuses on the fair treatment of the donor." Reich criticizes this argument for three reasons:

First, and commonsensically, a person...can rightfully decide how to dispose of those resources, then whatever a person decides to do with those resources—spend it on luxury goods or give it to charity—is by definition, tautologically, a kind of consumption.

i.e. Whatever you do with your post-tax money is up to you.

Second, there are obvious benefits that some, perhaps many or even all, donors receive in making a philanthropic contribution.

i.e. Giving benefits the donor (it isn't purely selfish).

Finally...donors quite frequently purchase with their charitable dollars rival and excludable material or intangible goods for which they are among the primary consumers. Contributions to one’s religious congregation are an obvious example; churches provide something more like club goods than public goods. Or to put it differently, they are more like mutual benefit rather than public benefit organizations.

i.e. Charitable donations usually fund club goods, not public goods (and taxes are supposed to fund public goods).

For these reasons, Reich mostly rejects the tax base rationale.

2. The Efficiency Rationale

The efficiency rationale (that the deduction efficiently stimulates public good production that is undersupplied by the state) is much more utilitarian:

What’s obvious about the efficiency rationale is that it shifts attention from the fair treatment of the donor to the recipient of the donation and the good that is done with the gift. ...Thus the success of the efficiency rationale depends on whether the benefits brought about by the subsidy exceed the costs of the lost tax revenue.

Reich boils it down to this question:

The relevant question is not merely, “Is philanthropy redistributive?” but rather, “Do philanthropic dollars flow more sharply downward than government spending does?”

Reich's key pushback on the efficiency rationale takes two forms:

First, there is inequality on the "supply" side of philanthropy (the givers). The U.S. tax system has higher tax rates for higher incomes. So the richer you are, the higher your deduction. Reich calls this the "'upside-down effect'—the deduction functions as an increasingly greater subsidy with every higher step in the income tax bracket." Or, stated as a statistic:

Those making $200,000 and above received 70 percent of all deductions for charitable contributions; those making $60,000 and above claim more than 98 percent of all such deductions.

Second, there is inequality on the "demand" side of philanthropy (the recipients). Empirically, donations can go to any random 501(c)(3) and often go to club goods for the rich (religious organizations, universities, and hospitals) not to public goods for the poor. I like Reich's analysis of this from a Pareto improvement perspective:

Atheists are vicarious donors to churches through the tax subsidy. By contrast, Catholics are vicarious donors to Planned Parenthood and its support for abortion rights. Such examples are easily multiplied. The basic point is that the subsidy cannot be justified as a Pareto improvement, where some benefit and no one is made worse off. At best, the subsidy is a Kaldor-Hicks improvement, where the gains for those who consume the particular social good produced by charity offset the losses to those with no interest in that social good.

In other words, when the government subsidizes Planned Parenthood donations, that is not a Pareto improvement because Catholics aren't too happy. This means it is, at best, a Kaldor-Hicks improvement, which is one where the benefit for one group is greater than the negative for the other group (i.e. it is positive only from a meta-societal utilitarian perspective). Still, a Kaldor-Hicks improvement doesn't necessarily negate the efficiency rationale. You can imagine a world where the deductions were mostly for the poor, and the benefits were mostly for the poor (so rich folks fall on the negative side of the Kaldor-Hicks). But the reverse of this is true! The rich get almost all of the deductions (70% go to those making >$200,000) and most of their donations go to club goods. Womp womp.

3. Pluralism Rationale

The pluralism rationale is more deontological than consequentialist. It claims—let's decentralize the production of public goods, even if it's less efficient! As Reich states:

Note that this is still a subsidy theory, but there is no necessary demand that the subsidy be treasury efficient. Even if there is a net loss to the treasury in the production of the social goods generated by nonprofit organizations—if the state could more efficiently deliver these goods itself—the pluralism rationale holds that the subsidy is nevertheless worthwhile.

Reich's main pushback on this argument both empirical and theoretical. The empirical:

The defender of the pluralism rationale has to answer to a disturbing feature of the historical record about associational life over the last century. It is no exaggeration to say that the rise of nonprofit organizations in the United States and the use of the charitable contributions deduction coincides with the decline of civic engagement and associational life, at least if the Robert Putnam literature is credible.

i.e. Civil society has deteriorated while charity deductions have increased!

Secondly, here's Reich's theoretical pushback:

Providing tax deductions for individuals who make charitable gifts does not honor the pluralism rationale but rather undermines and makes a mockery of it. As described earlier, a tax deduction for charitable contributions, when there is a progressive income tax, establishes a plutocratic element in the public policy.

i.e. Given a progressive income tax, deductions breed plutocracy, not democracy!

As stated above, Reich's conclusion is this:

While I find nothing to recommend the tax base rationale, the efficiency and pluralism rationales do offer potentially good reasons to support subsidies for philanthropy.

My takeaways:

- Woof, when you really look into a topic, there are a bunch of sub-items to truly determine societal benefits. i.e. I often just say "let's look at how philanthropy co-evolves with the state!" Reich actually dives into the sub-arguments to see whether we should give tax deductions/subsidies.

- I'm pretty convinced by his answer—we should not.

- I like the framework of the supply/demand side of philanthropy, especially looking at how the demand side generally takes the form of club goods rather than public goods. This framing can be applied to civil society incentives generally. e.g. We might need to create loops where philanthropy benefits the donor (e.g. through club goods or other benefits) in order to incentivize philanthropists to donate to civil society. See this article for other ways the benefits of giving can "loop back" to the donor.

The Role of Foundations in Modern Society: Pluralism and Discovery for Intergenerational Justice

Finally, Reich looks at the role foundations should play in modern society. He primarily sees two roles: pluralism and discovery. Pluralism is similar to the argument above (that civil society should also produce public goods in addition to the state).

Because donor preferences can be idiosyncratic, foundations can deliver idiosyncratic results. Foundations are thus well, if not uniquely, placed to fund public goods that are underproduced, or not produced at all, by the marketplace or the state.

Reich's second role, discovery, is like pluralism across time. It is the idea that philanthropic institutions with long time horizons can explore/solve problems that the government (with a short time horizon) won't solve. Reich uses the idea of "presentism" to convey how governments don't represent the interests of future generations well:

Dennis Thompson casts the issue a bit differently by identifying one of the built-in problems of democratic societies as a structural difficulty in representing the interests of future generations. He calls this the problem of “presentism”.

Thompson’s preferred solution to combat democracy’s presentism is democratic trusteeship, the idea that present generations can represent the interests of future generations by acting to protect the democratic process itself over time.

In the last chapter, Reich more deeply explores how combating presentism is part of intergenerational justice. Although I won't go into his arguments here, Reich contextualizes this within Rawls' theory of justice (it's quite interesting—go read the book!). My takeaways from this section:

- Intergenerational justice and presentism are powerful words. I could see them being used alongside words like racism, sexism, etc. i.e. If Social Justice Activists are combating racism and sexism for identity-based justice, Effective Altruists are combating presentism for intergenerational justice. (Or at least that's part of EA's impact-oriented conclusion.) The other things they're combating are speciesism (humans not caring about 70B factory farmed land animals) and localism/nationalism (folks in developed countries not caring about the 750M people in extreme poverty).

- I agree that something needs to represent future generations. I'm not sure if it needs to be foundations, or if some other mechanism could work.

Hope you enjoyed this review! I'd love for Effective Altruists (and people in general) to do more analysis on how civil society/philanthropy co-evolves with the state.

Here's a google doc with my full notes and highlights.

People are voting on the future articles I should write. To do so, go here!