Abundance: Money

In our last two posts, we defined abundance, and looked at abundance in trust. Today, we'll look at abundance of money. Our outline:

I. What is money?

II. Abstracting money

III. Abundance of money

IV. Abstracting the transfer of money

I. What Is Money?

Money is a complex, abstract resource. We've had many different forms of money over time: from shells, to gold coins, to digital money. So what is it?

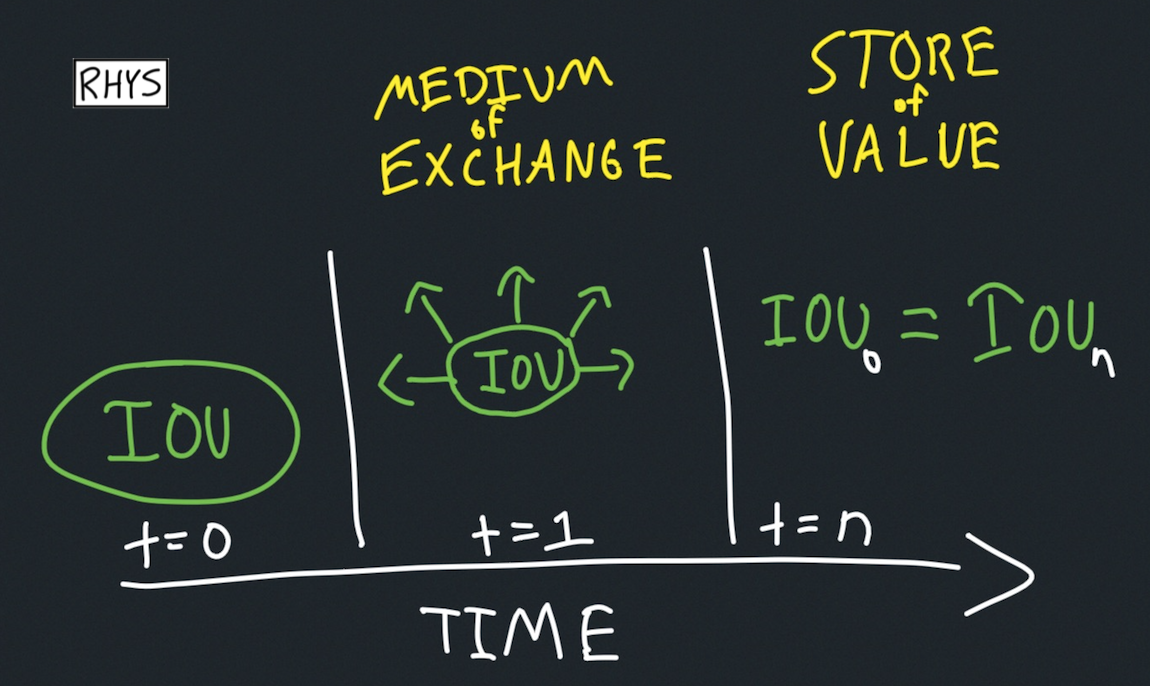

I like to think of money as an IOU. That is, it is a piece of value that can be used in the future. It is intimately linked to time. This translates well into the primary uses of money:

- Store of Value (SoV): This says that the IOU will keep its value well into the future.

- Medium of Exchange (MoE): This says that the IOU will be exchangeable with many parties in the near future.

We can see this in the time graph below. An IOU is a MoE if it is exchangeable at t=1 and it a SoV if it keeps its value a t=n.

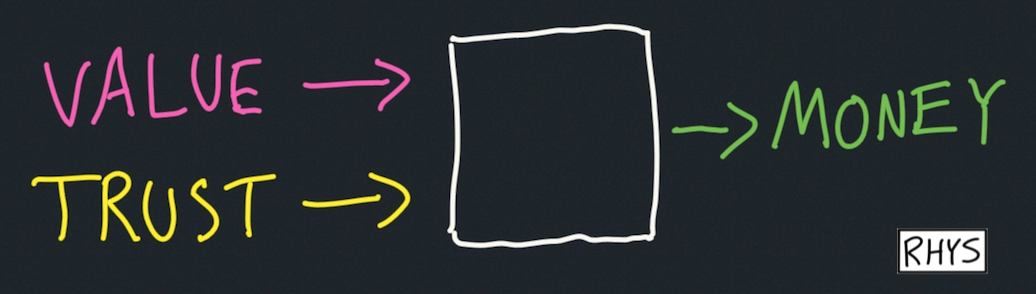

This IOU requires there to value (in the form of MoE or SoV). And it requires there to be trust (that those properties will hold true in the future). Now we can make our black box for money. This answers the question: how can we abstract/commoditize the process of making money? We need value and trust.

I.A How Does the Centralized Government Create Money with Laws?

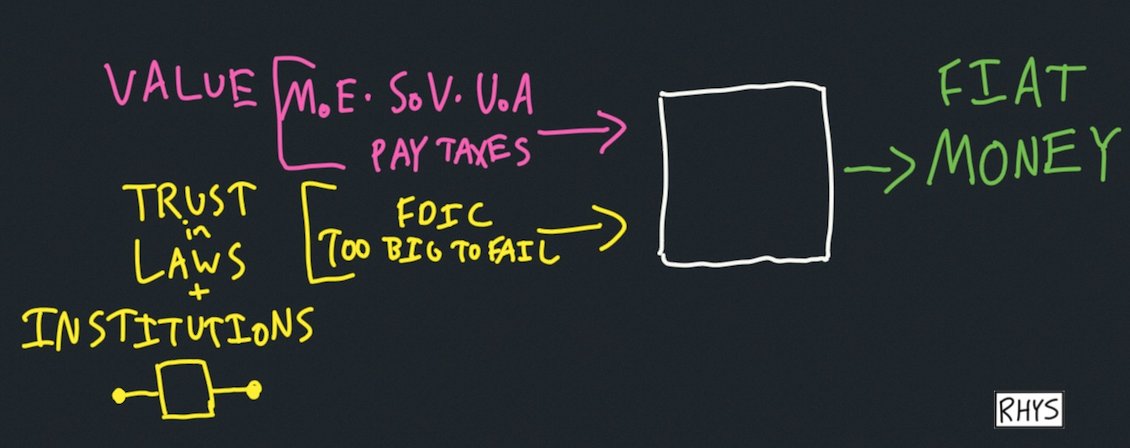

First, let's look at how a centralized government (the US federal government) leverages value and trust to make money.

USD has value because it functions as a MoE and SoV. If you have USD, you know you'll be able to use that IOU in the future to buy stuff. And no matter what, USD is required to pay US taxes, so there's a huge amount of demand for it. The government is like a big vacuum cleaner that sucks up USD, ensuring its value.

The other part of the equation (trust) is a bit more complicated. It's pretty clear that money is created from value. That's essentially all that money is—a wrapper around value.

But trust? Well, trust is the through-time component of money. It's the part of the IOU that says "at any time in the future your money will be a MoE and SoV". As we've seen in my past articles, the government creates trust with laws. For example, after bank runs during the Clutch Plague, the government passed a law in 1933 that created the FDIC. It says "if your bank can't give you back your money, then the government will give you back your money." For SoV, trust is created by the government committing to "not print too much money".

In the image below, we can see how the government uses value and trust to create money.

I.B How Do Decentralized Networks Create Money with Code?

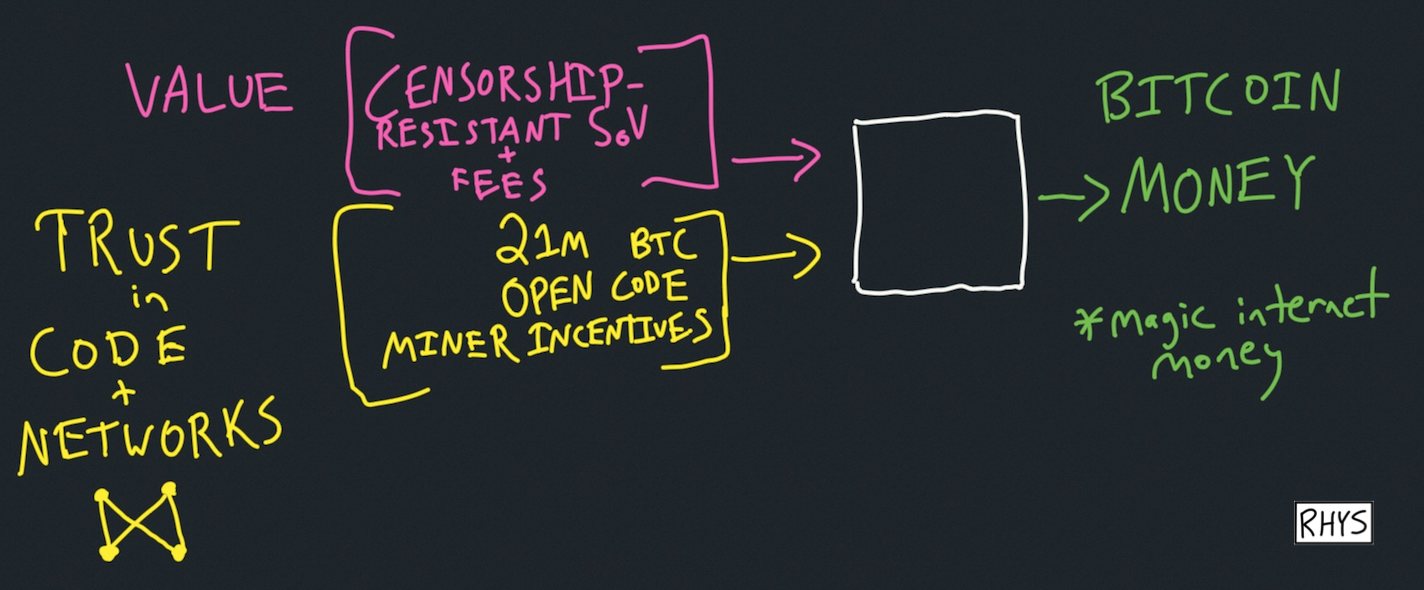

But with the invention of Bitcoin in 2008, it is no longer just governments who have the power to create money. We can now create money with code. How? Let's look at each piece: value and trust.

Value: The value of Bitcoin comes from its use as a censorship-resistant SoV. (Digital gold.) BTC is also used to pay for transaction fees on the Bitcoin blockchain. It's like a much smaller vacuum. (Bitcoin has had $1B in transaction fees all-time, while the US federal government had $3.5T in tax revenue in 2019 alone—around a 3,000x difference.)

Trust: With Bitcoin, the trust is in the decentralized network rather than a centralized government institution. This trust is enforced through code, not laws. For example, Bitcoin is trusted to be a SoV because it is hard-coded that there will only ever be 21M bitcoin. This number is trusted because we can transparently see the open-source code on Github. In addition, Bitcoin's ledger is trusted through a decentralized network of miners with financial incentives to maintain the ledger.

We can see value and trust in the image below:

So we know what money is (a trust-based time wrapper around value). And we briefly looked at how governments and blockchains made money. Let's explore that abstraction process further and use it to explore variable-quality abundance.

II. Abstracting Money

In the last thousand years, we've seen governments abstract the concept of money. First, we had commodity money—where the gold coin (or cowry shell) had "intrinsic" value (as the commodity itself). Then banks started giving deposit receipts for commodity money and those receipts (just pieces of paper) started circulating as money themselves. From ~1700-1971, many governments operated on the gold standard—they issued paper that could be redeemed for gold. But in 1971, the US government left the gold standard and all countries moved to fiat money.

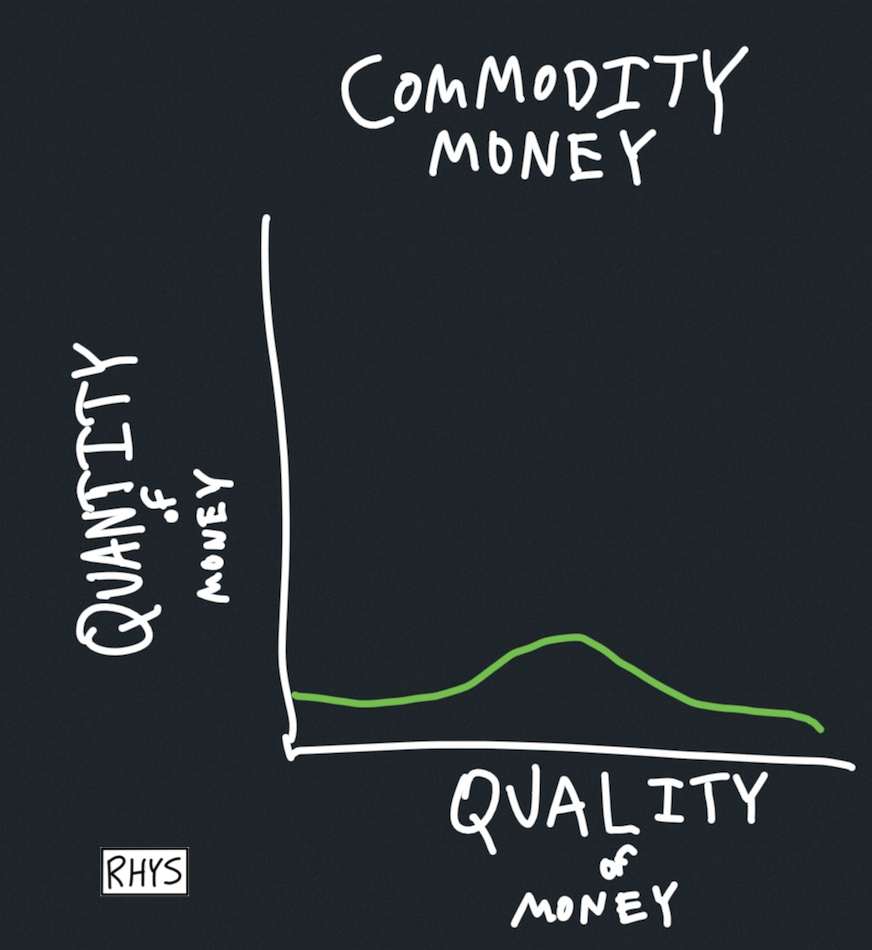

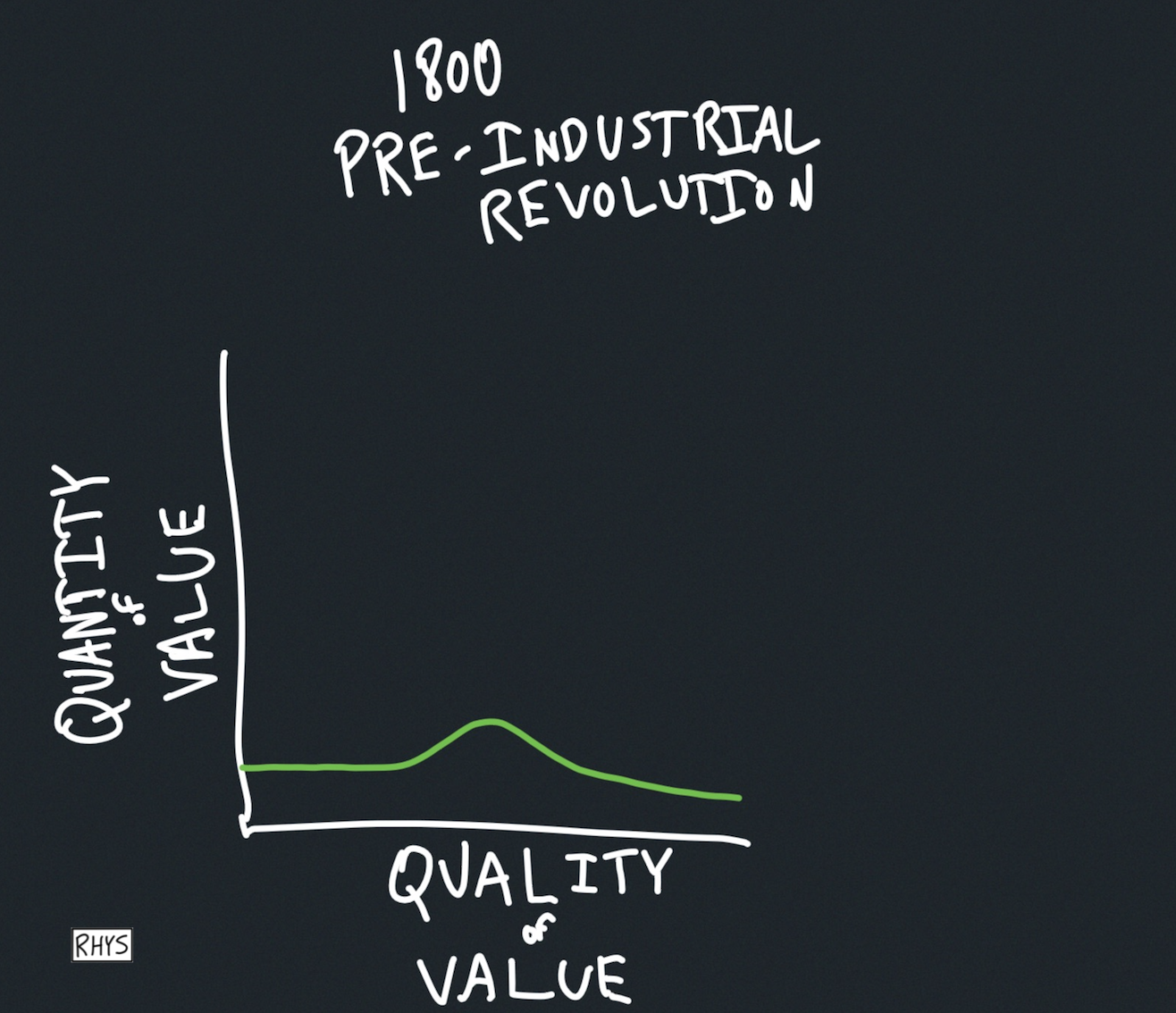

Let's look at each of these stages in turn. First, before governments abstracted commodities into paper money, there wasn't much money:

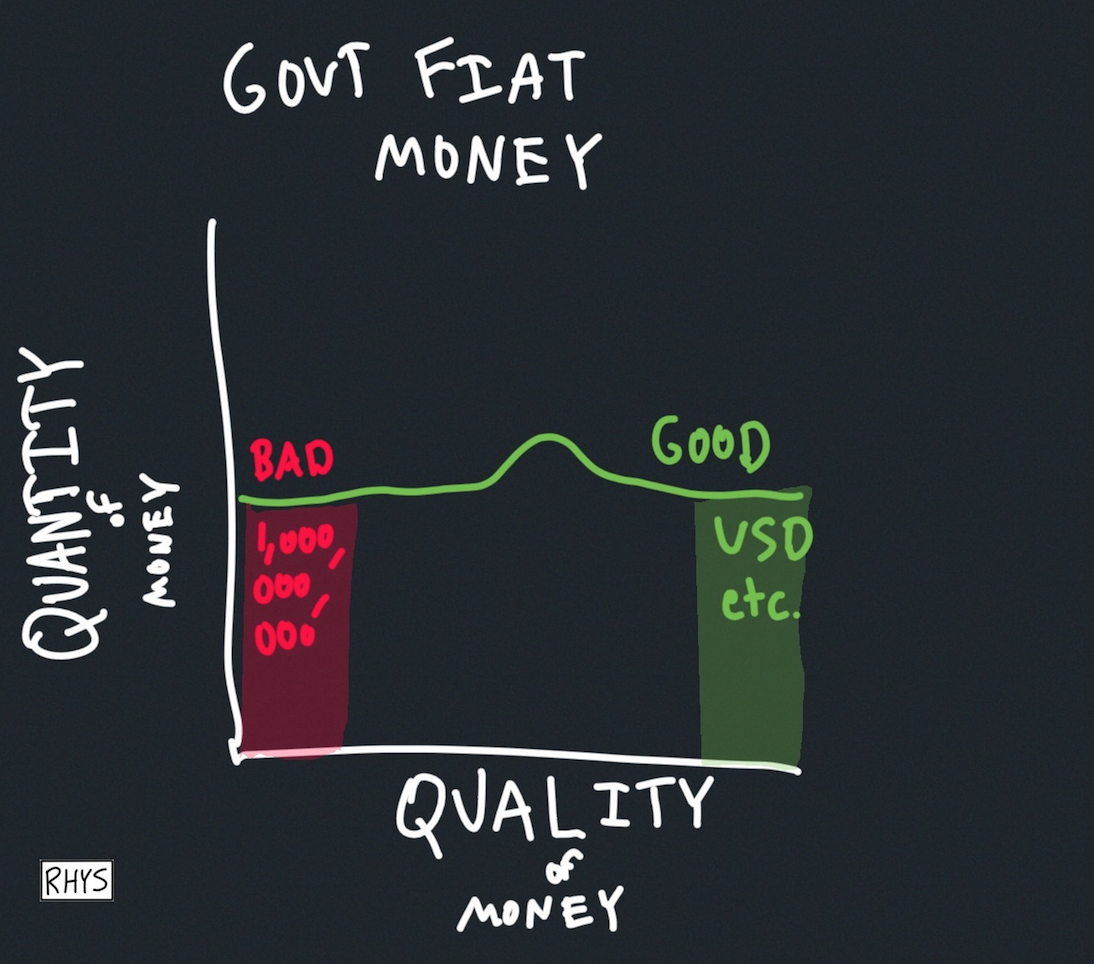

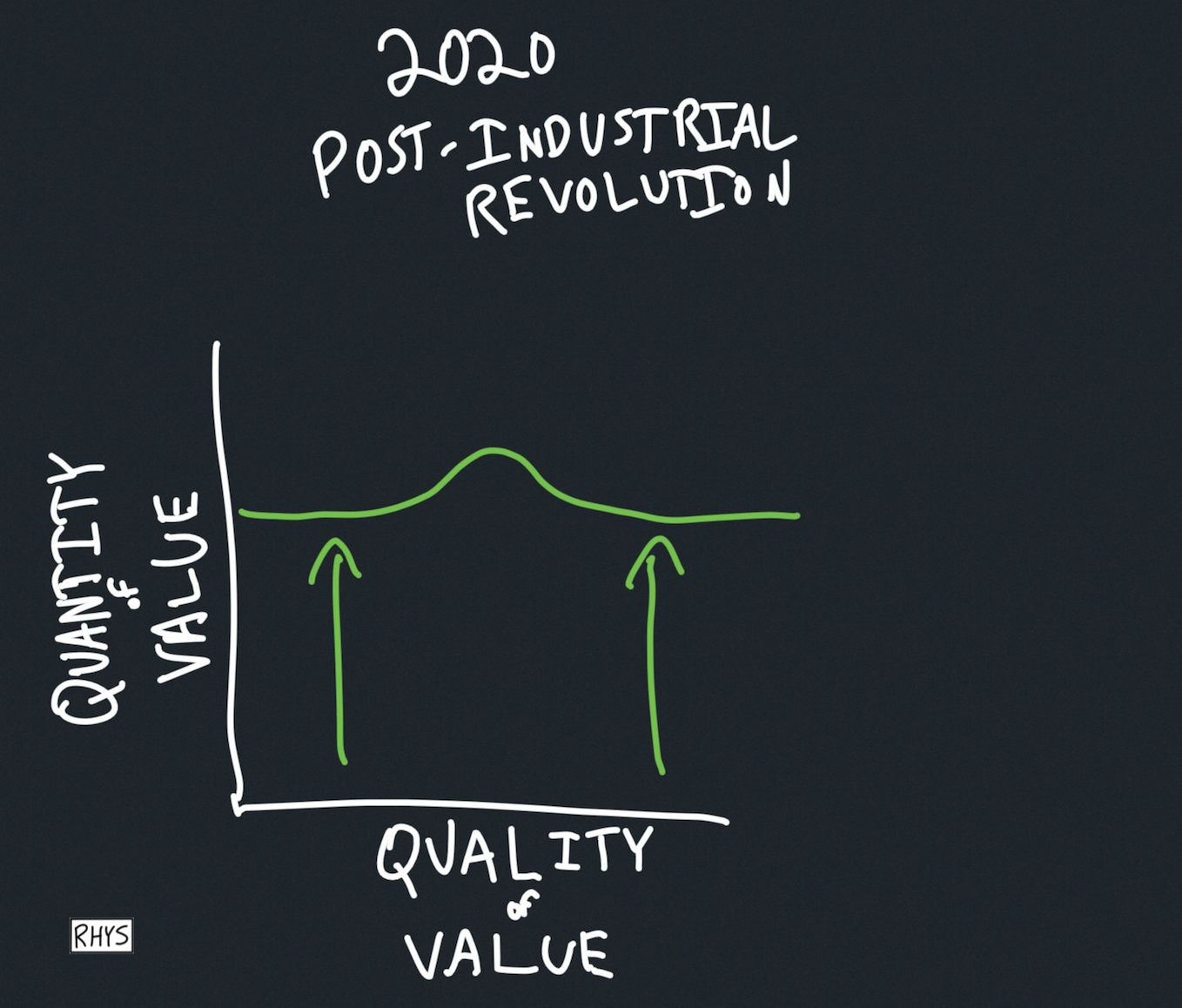

But then governments learned how to commoditize the process of printing money, and they printed more money.

This led to "good money" on the right like USD which was a good SoV. But we also had "bad money" on the left. Between WWI and WWII, the German Papiermark wasn't a good SoV. They removed it from the gold standard and printed too much money. Eventually the money was so worthless that it was more useful to burn it for heat than to use it for goods.

Although the Papiermark and the USD were of different quality, they used the same underlying process of abstraction (through government trust).

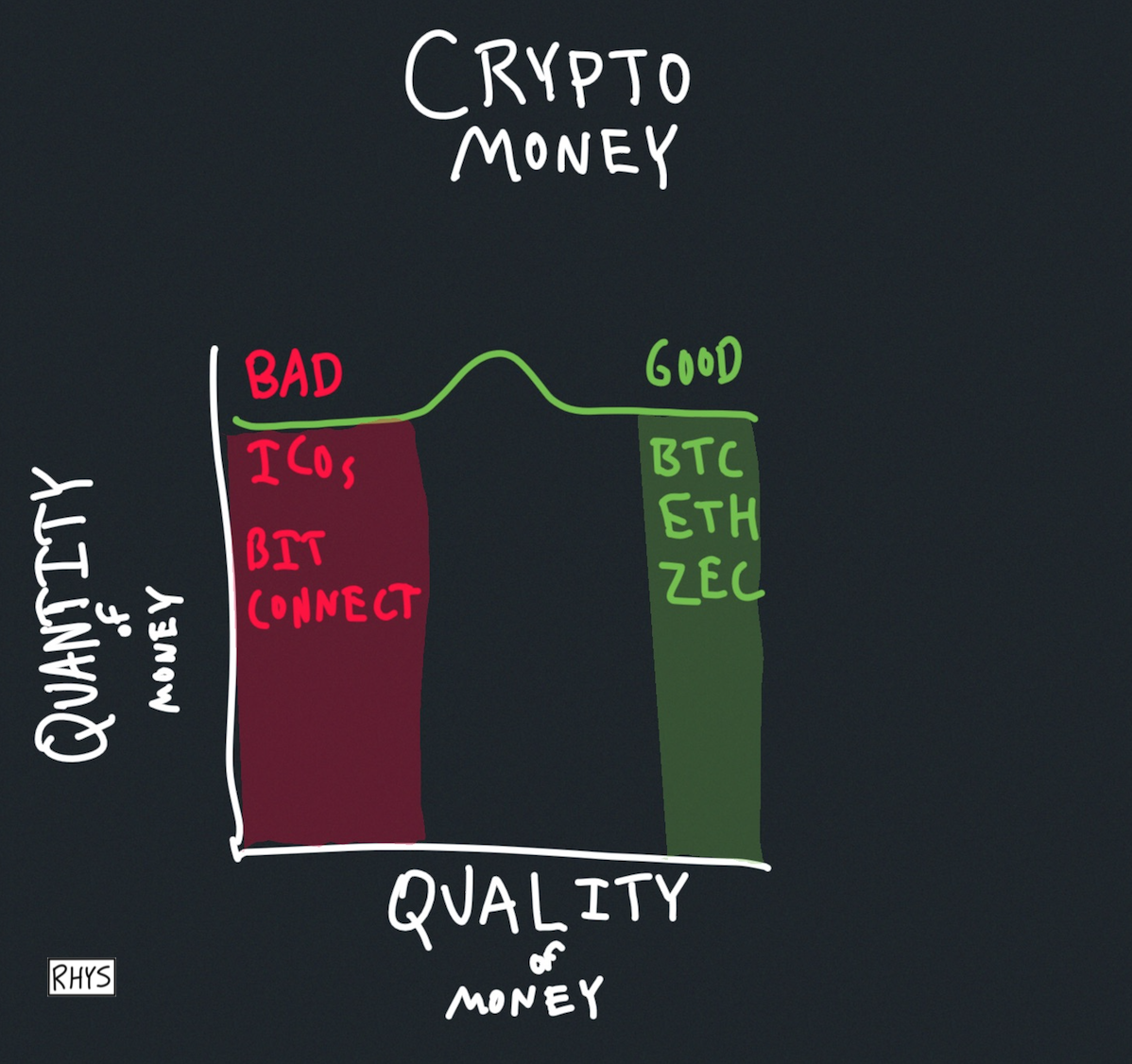

Now, with the new advent of programmatic blockchain money, we've commoditized the money creation process even more. You can just fork Bitcoin to create a new coin (e.g. Dogecoin). Or, with the standardization of ERC20, you can print money on the Ethereum blockchain (and sell it through an ICO). This led to a new explosion of cryptocurrency, and with it variable-quality abundance. Some of the money was "good" (BTC, ETH, ZEC, etc.) and some of it was "bad" (Bitconnect, etc.).

Remember that the inputs to make money are trust and value. Many of these new coins had a small amount of code-based trust (e.g. by hard-coding their supply). But very few of them had value to back it up. Although we protocolized the money creation process (through Bitcoin forks or ERC 20 ICOs), we haven't yet substantially changed its inputs (trust, value).

This is roughly analogous to our ability to distribute information, but not yet knowledge. We've protocolized the process of distributing info, but haven't (fully) protocolized the process of creating knowledge.

However, we have made substantial progress on the inputs to money: value creation and trust creation. This shows that the process of abstraction can be different that the process of abundance. Just because we've created a protocol for money creation doesn't mean that we've drastically increased its inputs. This would be like us creating the process of farming but without enough sunlight as input to create food. Or like creating the process of factory production, but without enough raw material as input to create t-shirts or steel.

III. Making the Inputs to Money Abundant (Trust, Value)

We discussed abundant trust in my last article, so I mainly want to focus on value. As we saw with ICOs, money is worthless if underlying value isn't backing it. So—are we progressing in our creation of value? Have we commoditized the value creation process?

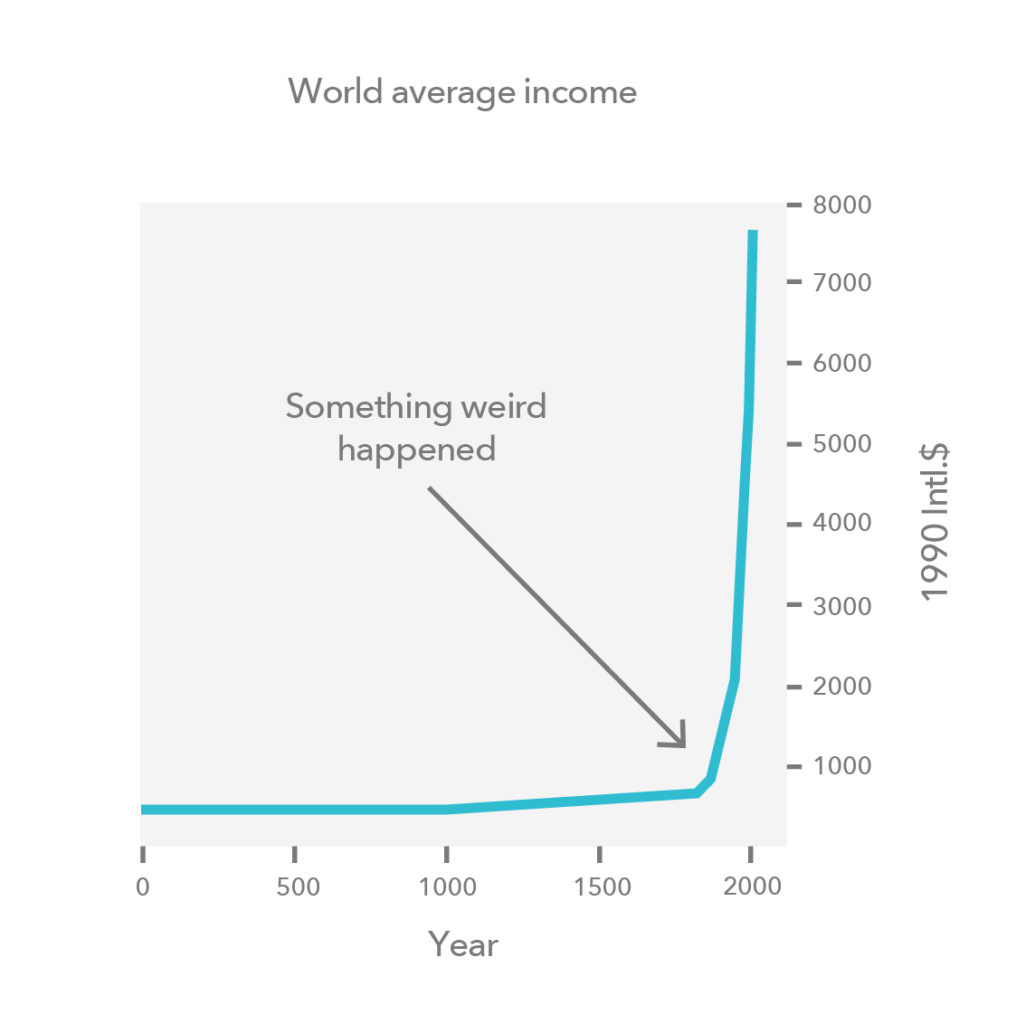

These questions are at the heart of Progress Studies—how do we create and sustain growth? But the tl;dr is—yes, since the Industrial Revolution we've created much more value per person.

The Industrial Revolution is the "weird thing that happened.

My favorite example of progress is in light. Thousands of years ago, 60 hours of labor would produce an hour of light (with a wood fire). Now, with the invention of candles, lightbulbs, and LEDs, that same labor now produces 60 years of light, a roughly 500,000x increase. (Hooray!)

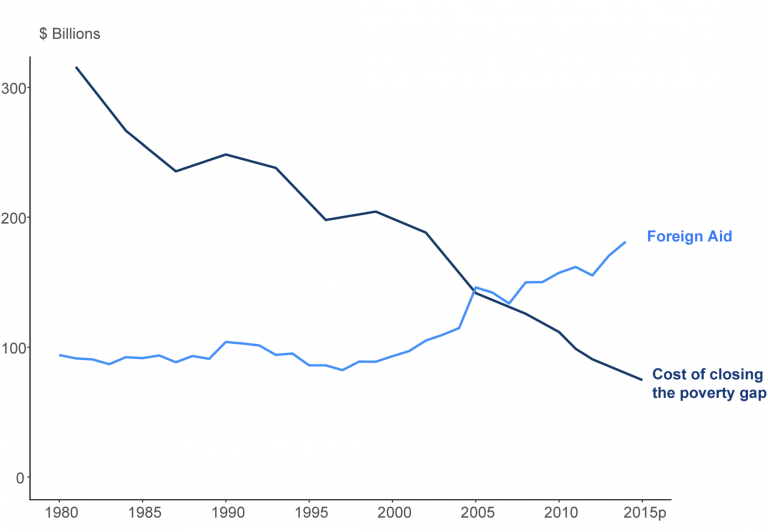

So yes, the graph above shows that we are shifting towards an abundance of value itself. It is easier to meet our needs than it ever was. There are a couple of other ways to see this:

- UBI is now an actual possibility. Back in 1800, when 50% of kids died before the age of 5 and almost no one had a basic education, UBI was a pipe dream.

- More and more folks are getting out of extreme poverty. For the first time in history, the cost of closing the poverty gap is less than the total amount of foreign aid.

No matter how you view it, we've gone from this:

To this:

Now that we've looked at abstracting the process of money creation (govt. fiat, ICOs) and value creation (Industrial Revolution and Progress Studies), let's look at how we're abstracting the transfer of money.

IV. Abstracting The Transfer of Money

Earlier, we looked at the creation of money as a primitive. i.e. How do cryptocurrencies/the government print money?

But we can also zoom out one level: Assuming we have money (as a primitive), how do we transfer it?

Or, put another way, how do we currently exchange money for value?

IV.A Capital-as-a-Service

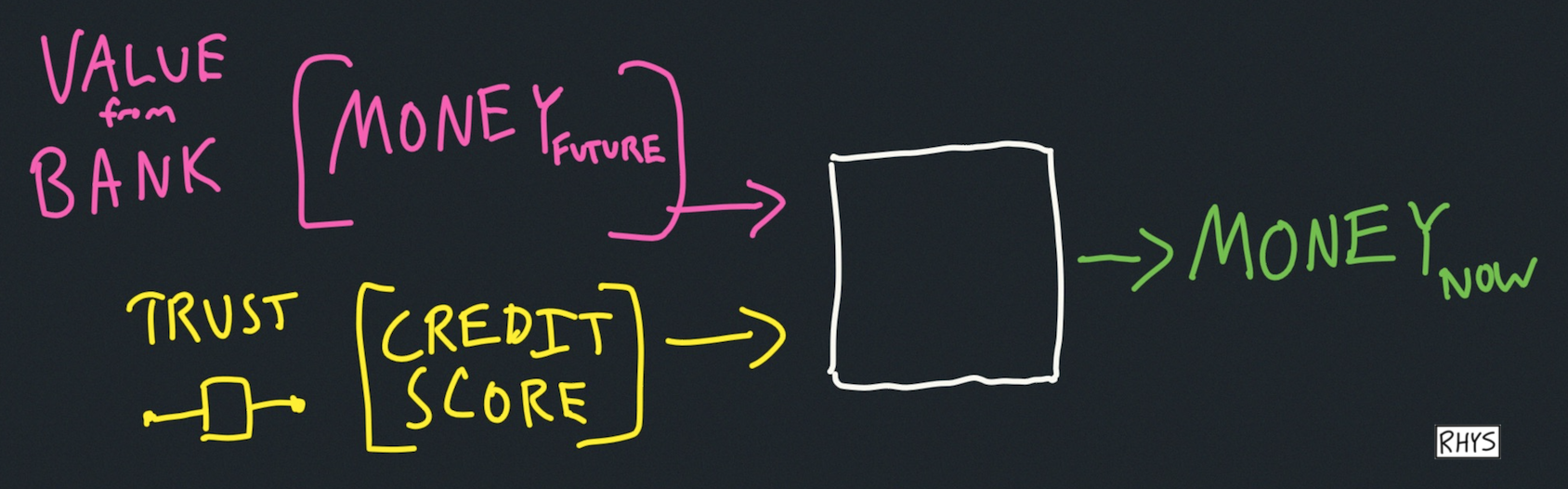

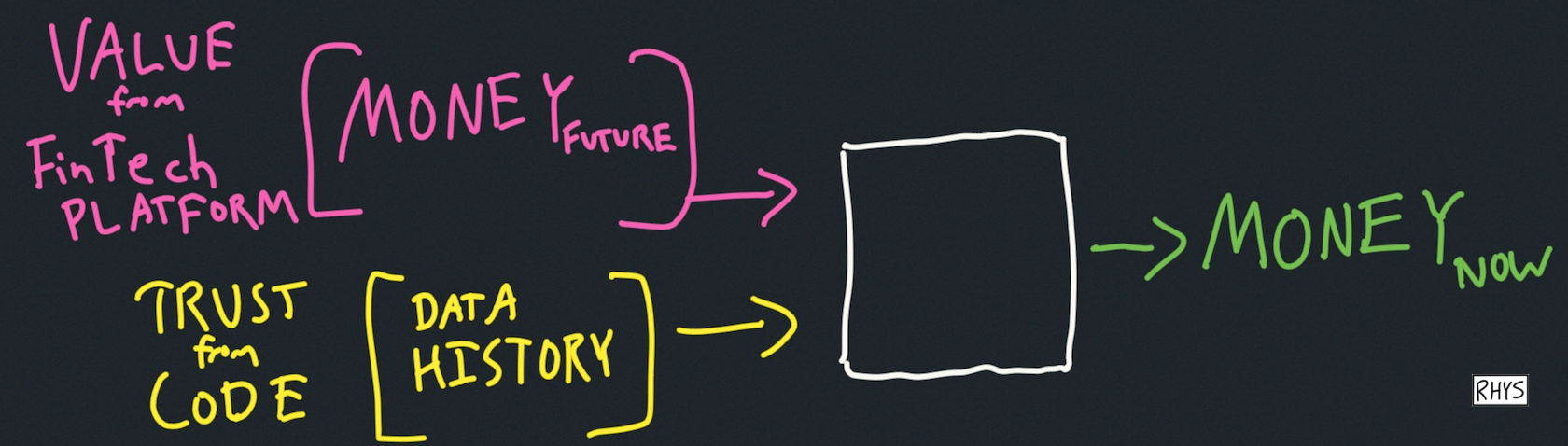

First, we exchange money for...future money. We can use the same black box: value + trust = money. Value = future money. Trust = a risk score.

Traditionally, this was done through banks and credit scores.

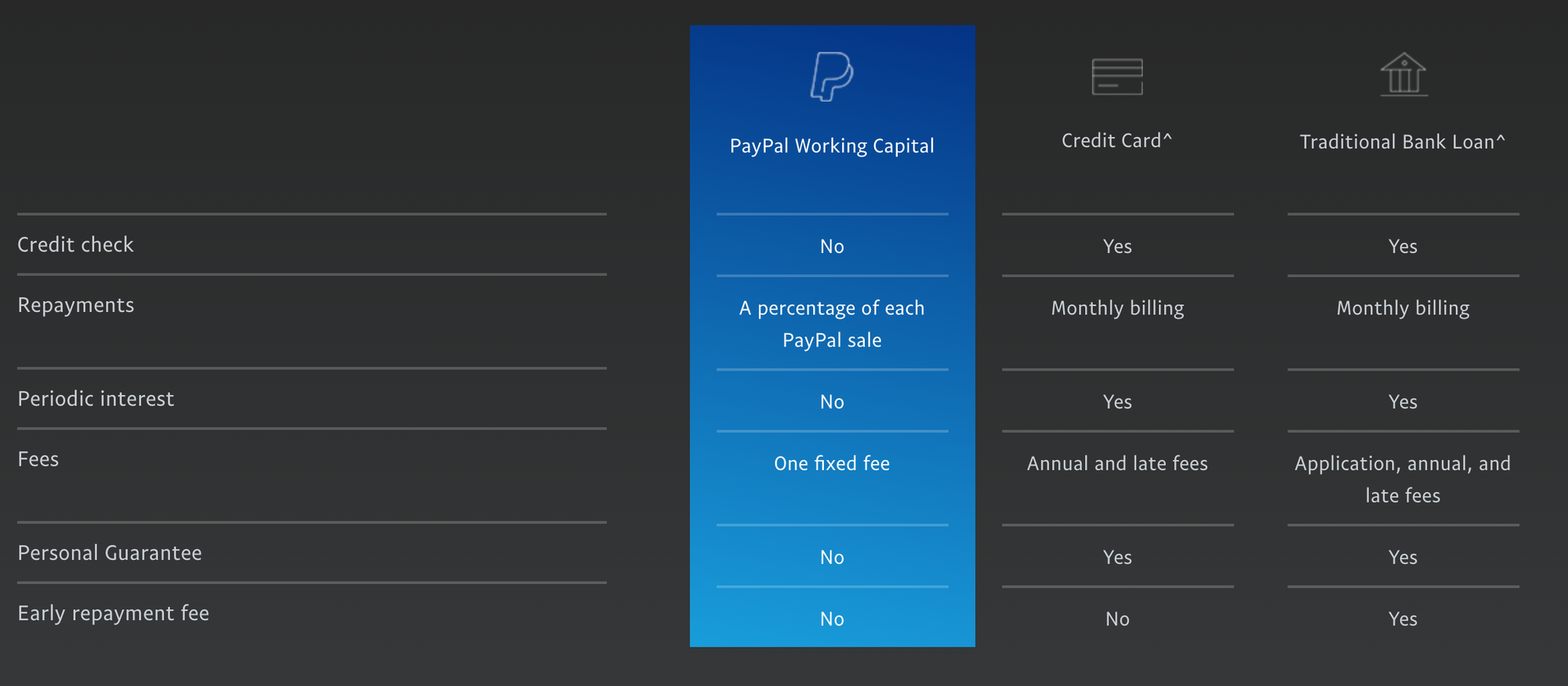

Now though, this same process is done programmatically through fintech platforms (Stripe Capital, Square Capital, Shopify Capital, PayPal Capital, and even Patreon Capital). The idea is that these platforms can replace credit score-based trust with user data-based trust to make it easier to go through them instead of the banks. This table from PayPal explains it well:

So instead, we get a code-based box that looks like this:

In fact, this "Capital-as-a-Service" abstraction is starting to creep into VC itself. As income streams become more consistent, companies can securitize those streams and sell them on the open market. Venture Debt is Coming.

ISAs also fit into this model. Individuals get value now (education) on the trusted promise that they'll give money back later.

IV.B Amazon is Goods-as-a-Service

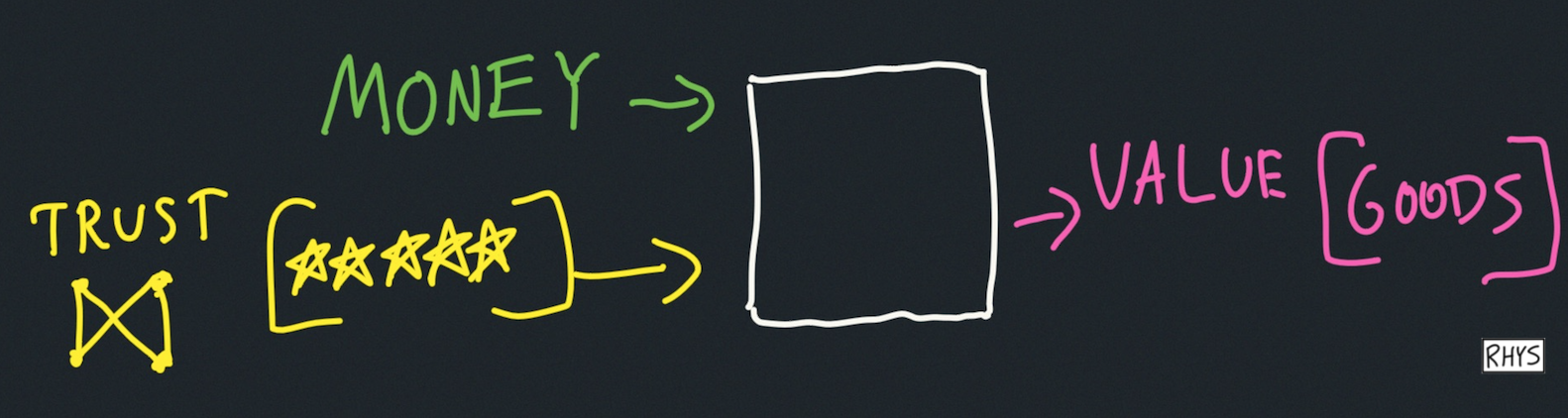

In the examples above, we traded money for future money. But we can also exchange money for goods. Amazon is one massive API for doing this—the Everything Store. Sears was the first pioneer of this model—in 1906 they had a 1200-page mail-order catalog. But now it's even easier with ratings-based trust and a commodified logistics stack.

We trade give the (trusted) black box money and it gives us value (as goods).

IV.C Gig Worker Platforms Are Labor-as-a-Service

I pay money and get services done. You can imagine a generalized API for this that wraps Uber, Task Rabbit, Fiverr, etc.

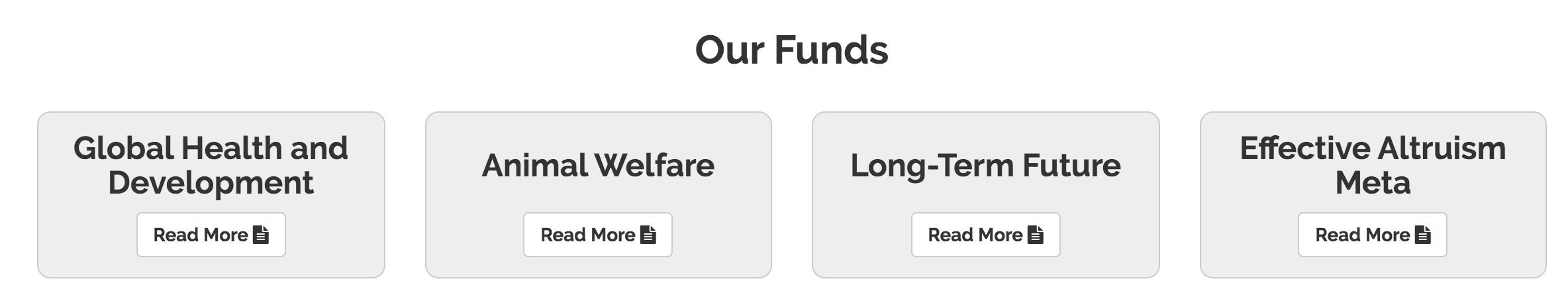

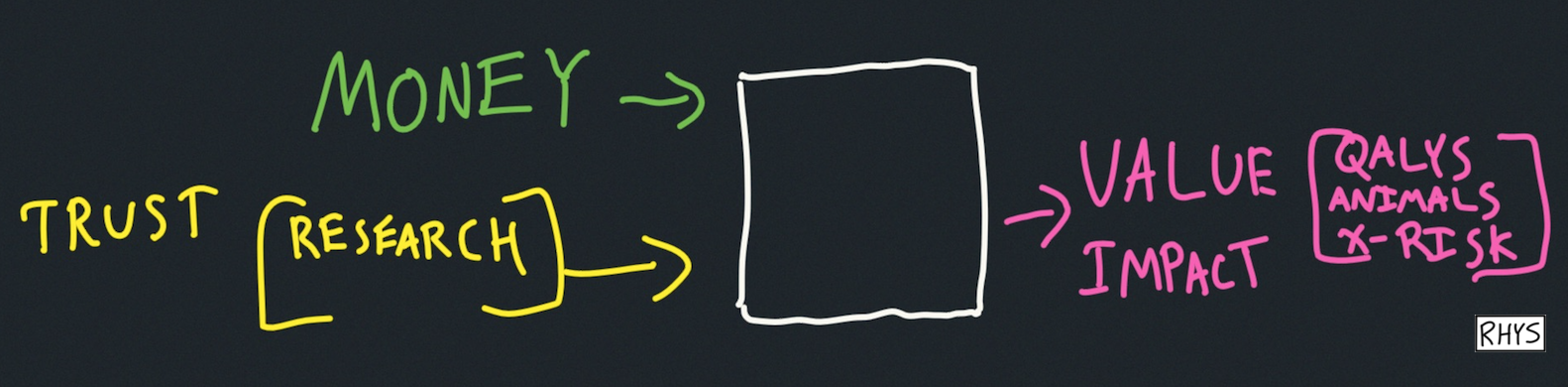

IV.D Effective Altruist Meta-Charities are Impact-as-a-Service

What if we want to trade money for impact instead? If we don't want something for ourselves, but rather want to make an impact by helping others. The effective altruist ecosystem, and especially meta-charities like EAFunds, allow us to "directly" access Impact-as-a-Service. The trust comes through an intense research/vetting process, and the value received in return is QALYs.

Give the (trusted) black box money and it will give you impact in return.

CONCLUSION

In conclusion, we looked at:

I. What is money?

II. How to abstract money (with govt. and code)

III. Making the inputs of money abundant (creating more value)

IV. Abstracting the transfer of money

Next time, we'll look at how scarcity emerges in response to abundance, and why generosity and meaning are the natural responses to an abundance of money.

As always, I'd love your feedback. Thanks!

Notes:

- I used to call this "the abundance of capital" , but I think capital is too general. e.g. Right now, we're building up social distancing capital. That's not "money" in the traditional sense. I wish I understood capital better. It's kind of like potential energy, and kind of like leverage.

- A crucial learning for me within this essay is that abundance and abstraction are orthogonal to each other (though often correlated). ERC 20 abstracted money creation, but did not make the inputs (and therefore the output) abundant.

- The protocolization process is powerful. It shows what we need as inputs.

- The story/meme is a huge part of trust. I wasn't sure exactly how to add that.

- What is x-axis of the variable-quality abundance graph for value? Is there "bad" value? As it the case with all good/bad questions, we just "ask the Bento" and it tells us that "if it meets needs, it's good". This implies that an unequal distribution would be bad.

- Was there a "bad" commodity money? Tulips perhaps? Or a better example is the Roman gold coin that got increasingly diluted.

- I didn't talk much about money-adjacent ideas, like securities or commodities. A security is a thing that you buy and hope other people make it go up in value (like a stock). A commodity is a fungible resource that is used as an input for production (corn, oil). See this overview from Nick Grossman.

- On regulation: For money, the Fed regulates macro systemic risk, while FinCEN regulates illegal transactions. The SEC regulates securities (protecting investors). The CFTC regulates commodities and futures (protecting consumers). For more, see slides from my MIT class on financial ethics.

Crypto and Programmatic Money

- Would've liked to chat about "programmatic" n-dimensional money here. The abstraction process of government money collapses nD value into 1D (a slip of paper). With crypto, we can expand back to nD money.

- Perhaps the thing I most wanted to add to this piece was Fairmint and their programmatic Continuous Securities Offering. It's the securitization thesis (Capital-as-a-Service) on steroids.

- Related: I would've liked to talk more about all the money legos in DeFi. CFMMs!

- For more on the difference between crypto and Stripe, see this great question thread from Jesse Walden. tl;dr—crypto is permissionless and has a modular ecosystem. (Also, this follow up.)

- Another great part of switching to more code-based money is to open up (and stop rent-seeking) from banks. Right now we (annoyingly) need to use adversarial interoperability to access their APIs.

- Crypto is still super small compared to the rest of "money". There's only $200B total crypto, while there's $8T total gold (40x more), and $70T total money (400x more).

- You can imagine "baking in" the goodness into money. For example money with demurrage / negative interest (a balancing feedback loop) is be better than money that has compounding interest (a reinforcing feedback loop).

- I'm still inspired by this crypto-UBI prototype from 5 years ago. It contains many crucial primitives for "good programmatic money". It's called Taxeme. The high-level idea is that we can view money as a network, with different kinds of money in that network. The money that has the best backwards propagating tax system (kind of like VAT) would outcompete the other money.

- This 1min 50sec video from Square shows how easy it is to get Square Capital. The shorter the video and the less clicks, the more the service has been abstracted.

- Here is Social Capital's original Capital-as-a-Service program that abstracted the progress of raising from VC. No hoops, no $7 artisanal coffee chats, no designer pitch decks, no bias, no politics, no bullshit.

- There's a couple of hip pieces on why Shopify should stay B2B instead of B2C. Shopify is abstracting Goods-as-a-Service for storefronts, NOT end users. See Stratechery's piece on this or Divination's piece.

Other Readings:

- World After Capital. Goes into a bunch of great ideas, like transitioning from the Job Loop to the Knowledge Loop, and the kinds of freedoms we need to succeed (e.g. UBI as financial freedom).